Reverse mortgage calculator without personal information

A reverse mortgage allows seniors to borrow against their home equity. Mortgage blog Products and programs.

Downloadable Free Mortgage Calculator Tool

By submitting this request for information I hereby provide my signature expressly consenting to receive information by email or phone via automated dialing systems texting andor prerecorded messages from or on behalf of Finance of America Reverse LLC and its fulfillment partners and may agree to receive other offers on the telephone number I provided above.

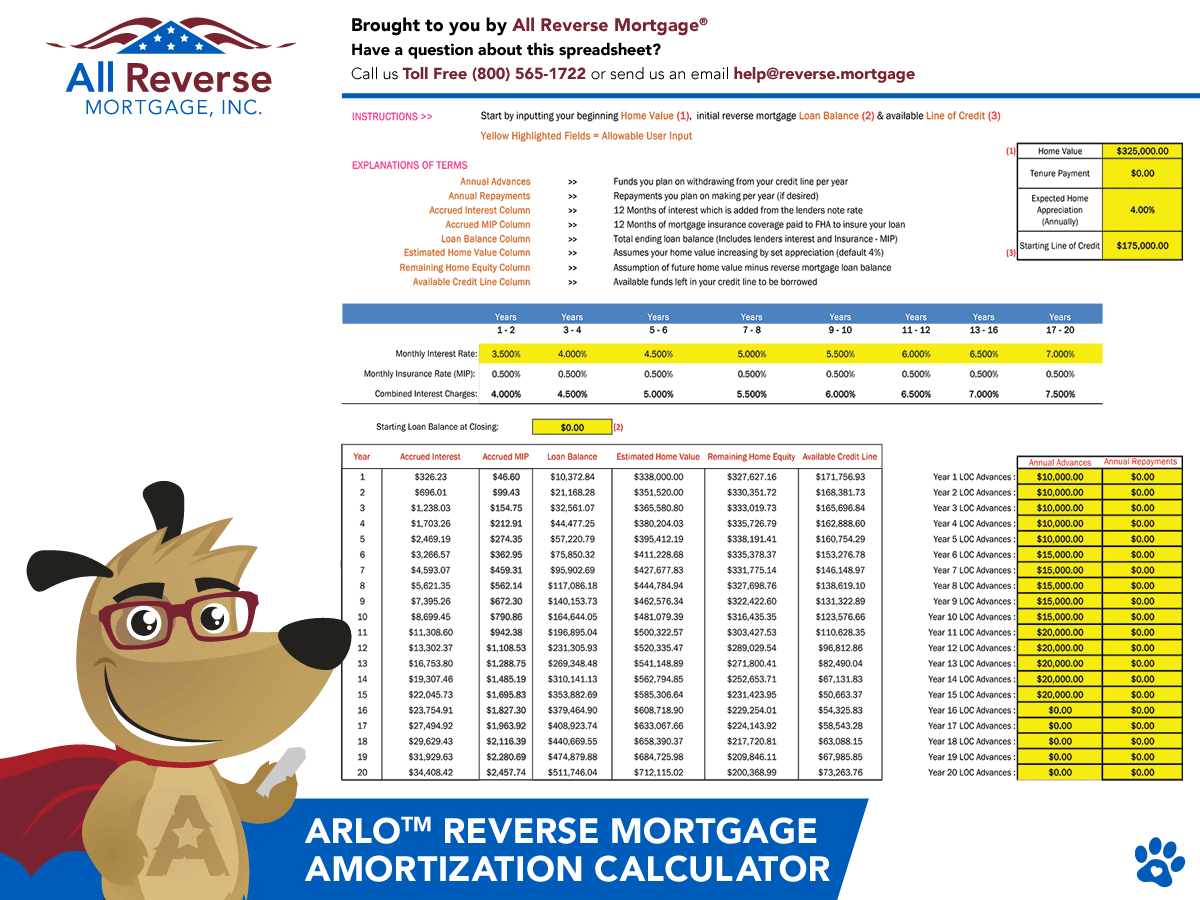

. Download our FREE Reverse Mortgage Amortization Calculator and edit future appreciation rates interest rates and even future withdrawals. If you have a home equity loan or variable-rate mortgage pay attention to the Fed. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older.

A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. You want to maximize returns and minimize losses. Enjoy your tax-free cash without making any payments until you move out or sell your home.

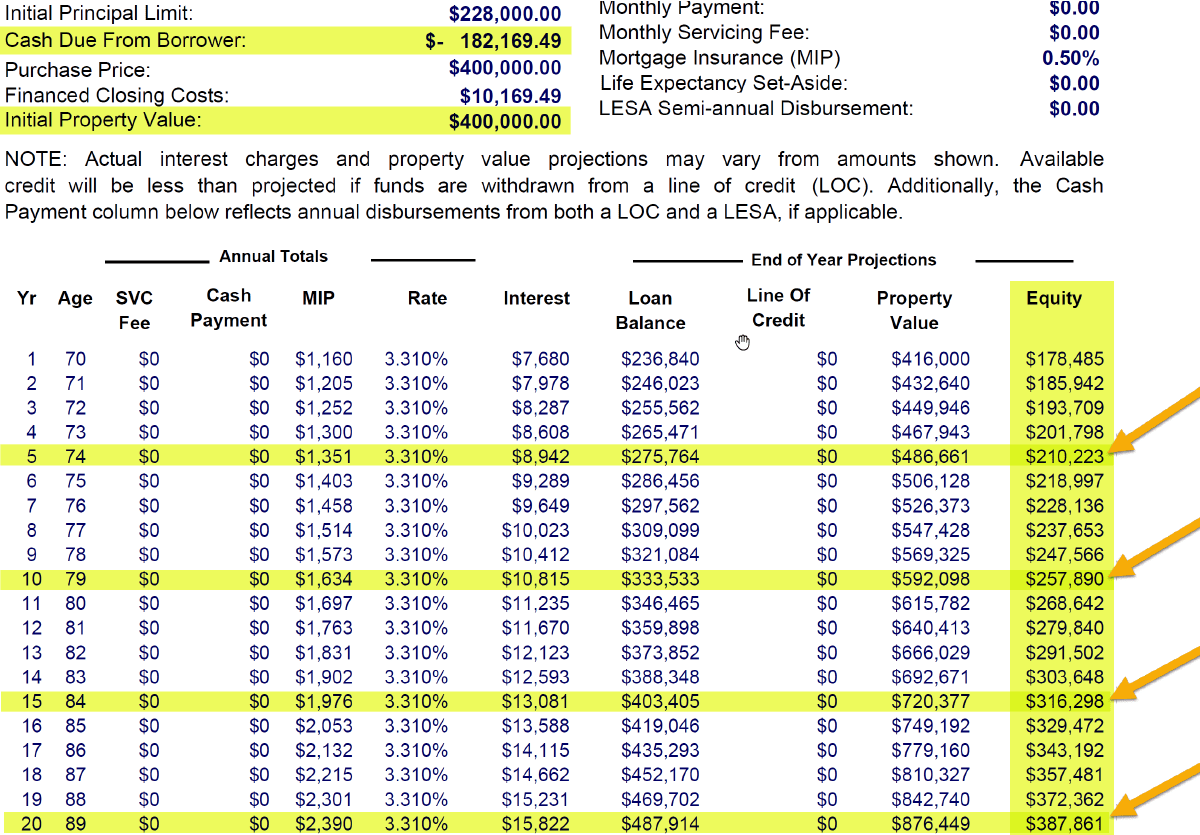

You can get a reverse mortgage when buying a new home requiring less cash to purchase and therefore increasing your buying power. You originally obtained your loan when the lending limit was less than the 2022 Home Equity Conversion Mortgage HECM limit of 970800 and your value is at or higher than the HUD limit especially the limit that was in effect at the time you closed your loan. Can be used to purchase a new home.

Get your free guide today to learn how reverse mortgage works. What Reverse Mortgages Can Be Used For. Mortgage blog Mortgage 101.

2 min read Sep 15 2022 Latest mortgage news. Try our reverse mortgage calculator. Your home value has increased considerably.

Maturity events that require reverse mortgage payoff. REA can connect you with our referral partner ubank part of National Australia Bank Limited ABN 12 004 044 937 AFSL and Australian Credit Licence 230686 or introduce you to a mortgage broker accredited with. Should you go 12 months without making any interest repayments.

With a reverse mortgage interest is added to the loan balance monthly based on the interest rate your loan carries. Find a loan officer. When to consider a refinance of your reverse mortgage.

Or a maturity event might be reached automatically due to the homeowners death or illness. Why we chose this company. The AAG Advantage Jumbo Reverse Mortgage.

CMHC insurance is mandatory for all mortgages in Canada with down payments of less than 20 high-ratio mortgages. Proceeds from a reverse mortgage first pay off existing mortgage lines allowing you to enjoy retirement without the monthly obligation of a house payment. This website has been prepared without taking into account your objectives financial situation or needs.

This locks in your current home value and your reverse mortgage line of credit over time might be larger than future real estate values if the market goes down. You can trigger a maturity event yourself for example deciding you want to sell your home. A reverse mortgage is a unique financial tool unlike any other in that it offers borrowers the ability to access their home equity without the burden of monthly mortgage payments¹ Using a reverse mortgage you can access cash to supplement your income in retirement and age in place in your home.

Personal finance can be complicated. Anytime a maturity event is reached your reverse mortgage comes due. When we analyzed government-backed Home Equity Conversion Mortgage HECM rate data from March 2021 to March 2022.

If you have built up a lot of equity in your primary residence maximizing your retirement portfolio may be difficult with the payout limits of government-insured reverse. Home equity conversion mortgages HECMs the most common type of reverse mortgage are. For more information on mortgage default insurance rates please read our guide to mortgage default insurance CMHC insurance.

By choosing Longbridge Financial you may be able to minimize those costs. This is an additional cost to you and is calculated as a percentage of your total mortgage amount. The AAG Advantage Jumbo Reverse Mortgage is AAGs privately offered reverse mortgage intended exclusively for owners of high-value homes.

Rates surge further past 6 a 14-year high. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. Rules work is interest becomes deductible when an actual repayment is applied to the interest.

How does a reverse mortgage work. You will not see an interest deduction for. A Reverse Mortgage can be one of the levers you use to maximize your overall wealth.

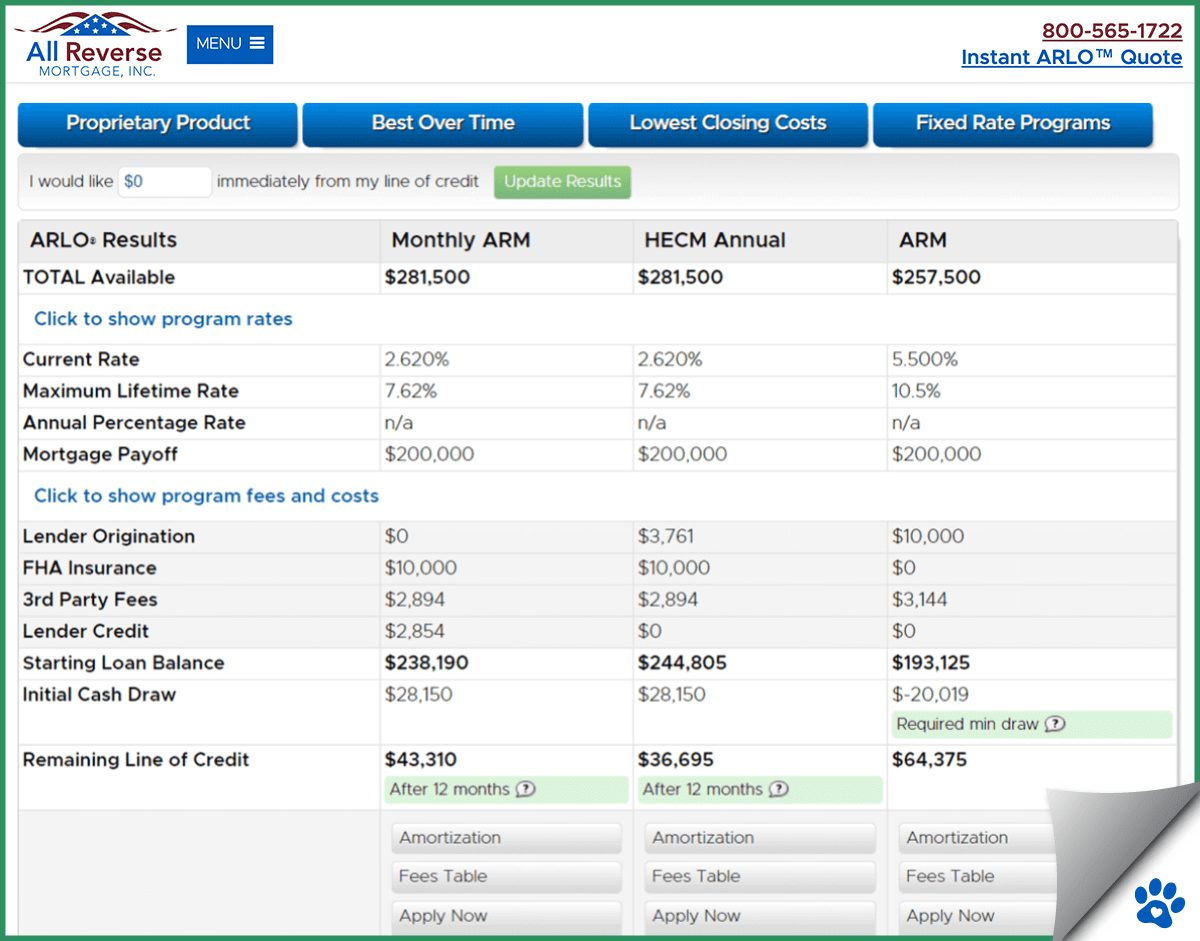

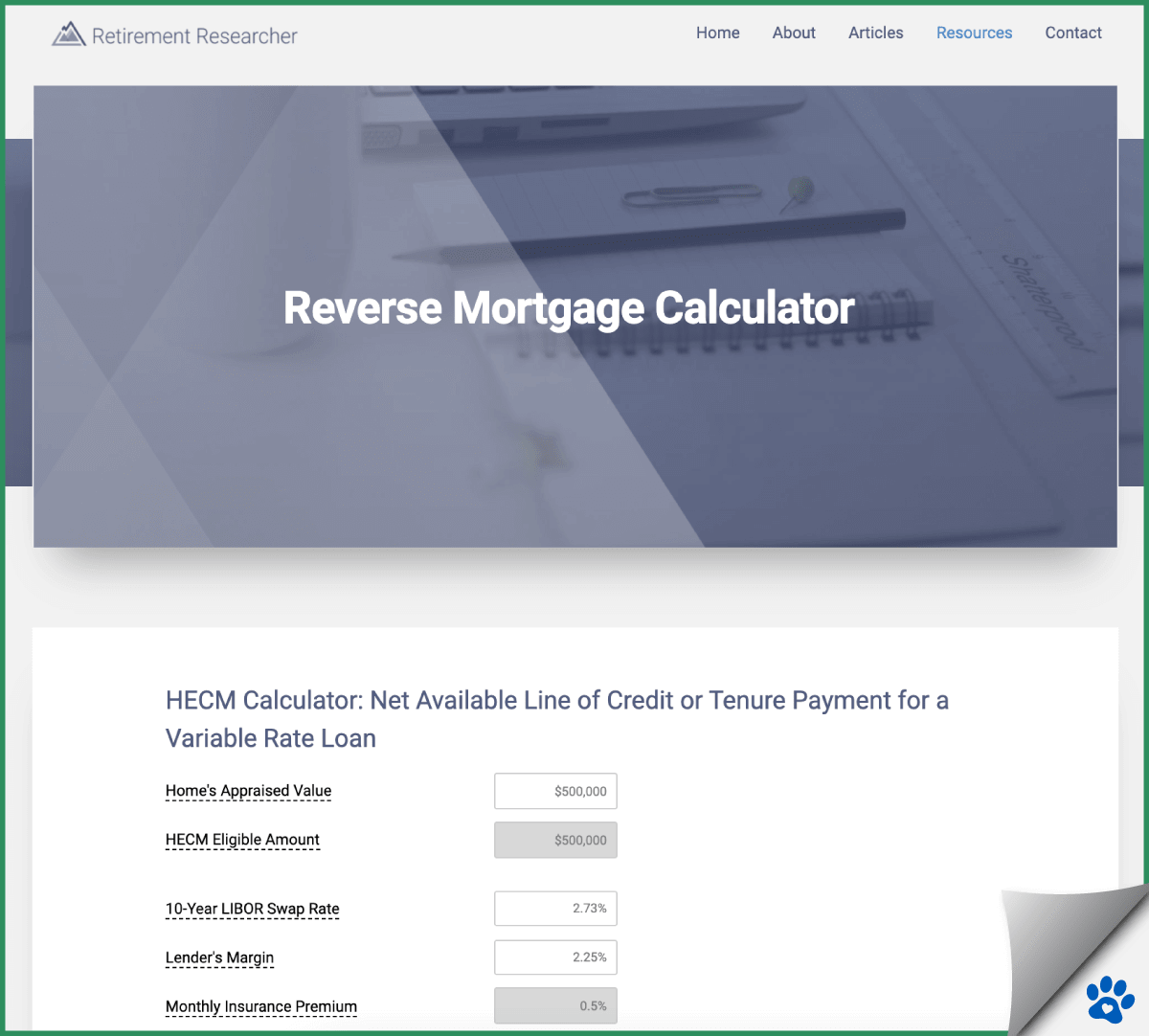

Top 3 Reverse Mortgage Calculators In 2022 No Personal Info

Free Reverse Mortgage Calculator No Personal Information Reversemortgagereviews Org

Top 3 Reverse Mortgage Calculators In 2022 No Personal Info

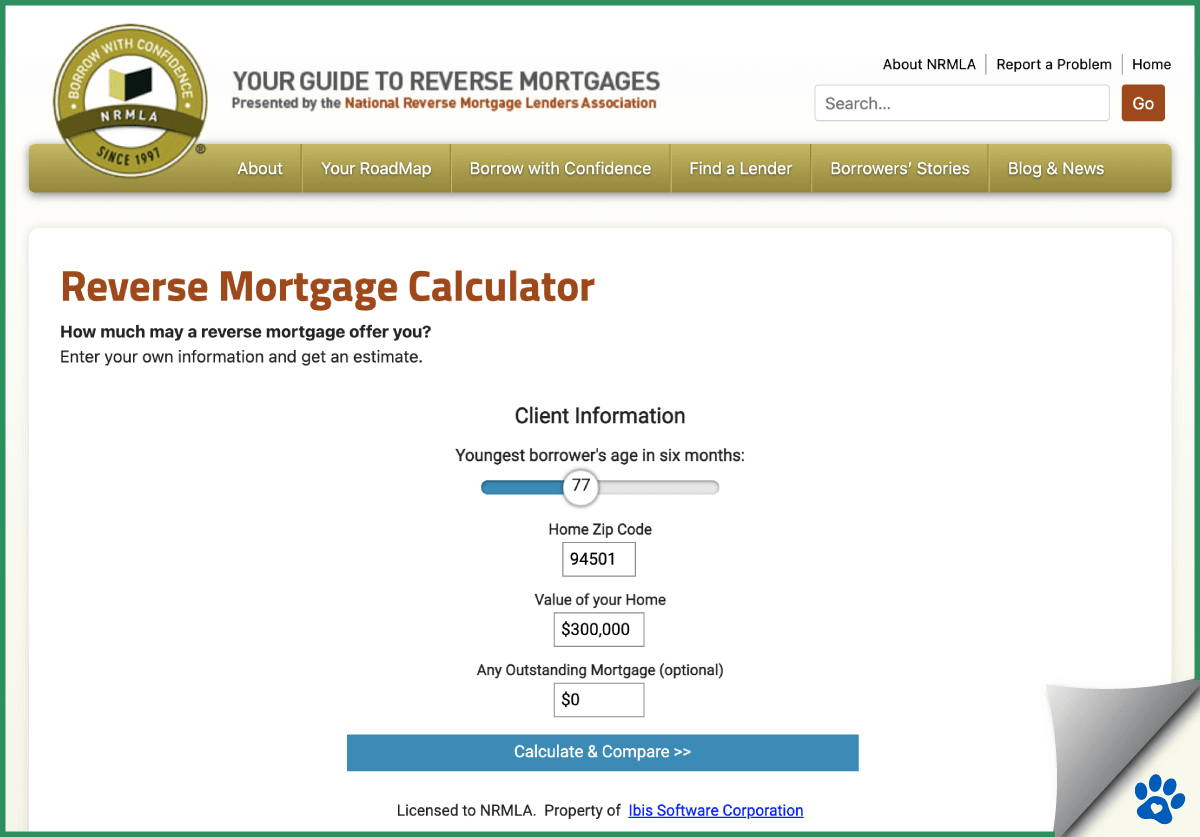

Hecm Calculator Reverse Mortgage Calculator No Contact Info Req D

Top 3 Reverse Mortgage Calculators In 2022 No Personal Info

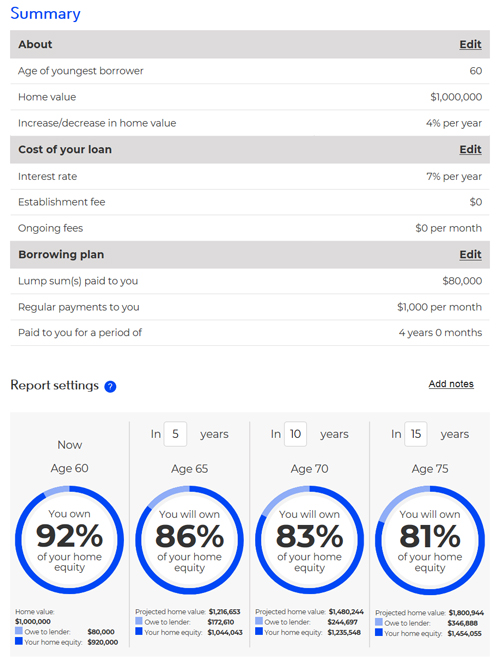

Reverse Mortgage Calculator How Does It Work And Examples

6 Best Banks Offering Reverse Mortgages In 2022 Reversemortgagereviews Org

Downloadable Free Mortgage Calculator Tool

Reverse Mortgage Purchase Down Payment Rates Eligibility

How To Compare Find A Reverse Mortgage Lender Moneygeek Com

Free Reverse Mortgage Amortization Calculator Excel File

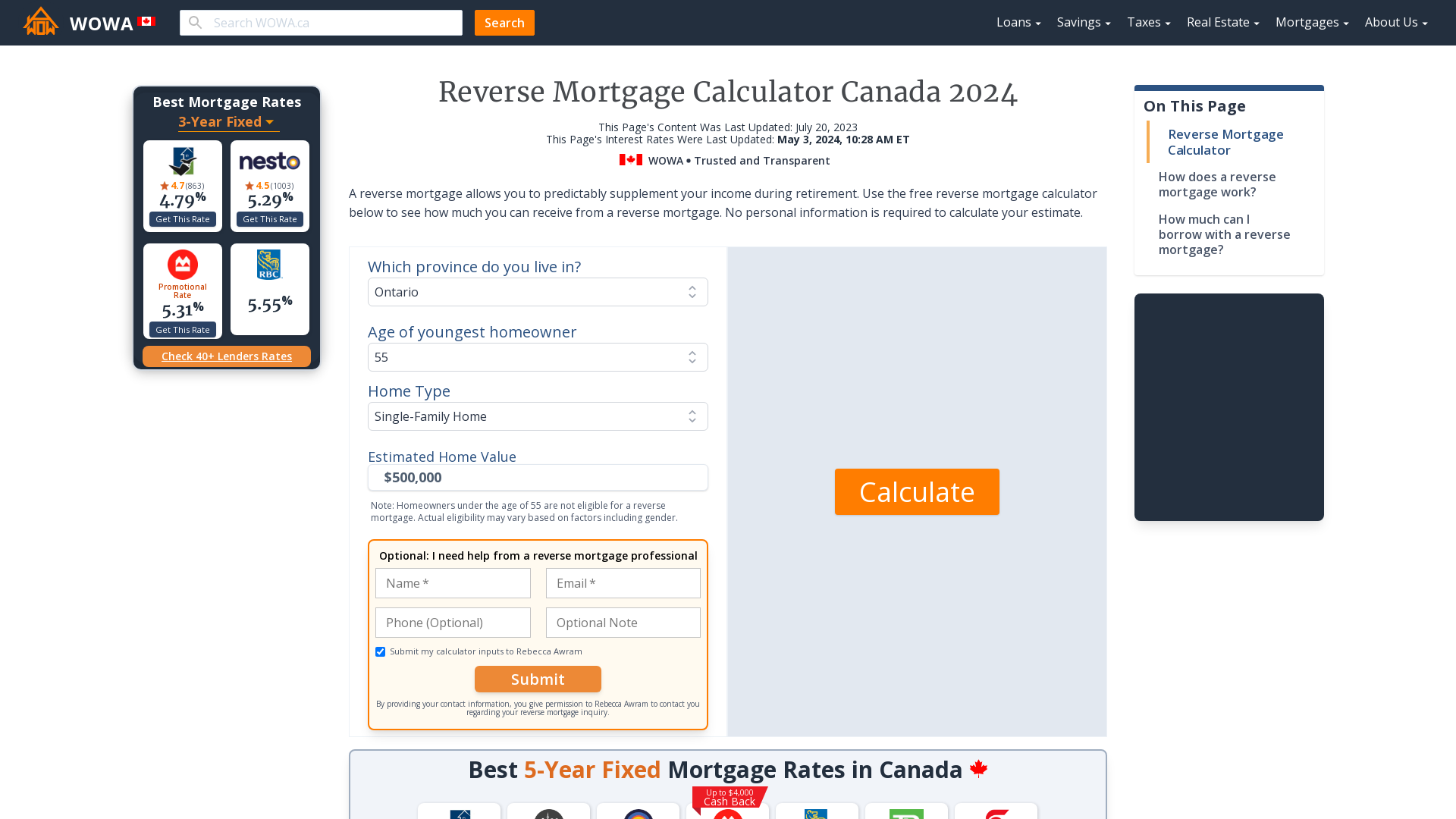

Reverse Mortgage Calculator Canada No Personal Info Required Wowa Ca

Reverse Mortgages And Estate Planning Lendingtree

Top 3 Reverse Mortgage Calculators In 2022 No Personal Info

Using Asic S Reverse Mortgage Calculator Asic

Reverse Mortgage Calculator Reverse Mortgage

Reverse Mortgage Calculator